Ethereum (ETH) is once again losing momentum after exhibiting a positive bounce the previous week. At the time of publication, ETH has a market valuation of $125 billion and is currently trading 9 percent lower at $1032.

The second-largest economy in the world is unmistakably losing strength, and if it cannot maintain $1,000, it may go as low as $700 or even lower.

Ethereum Falls Below $1k

Over the past few hours, the price of ethereum has deviated from a key level of support and fallen under $1,000. This is why more selling pressure might cause a downturn below $900 or even lower.

To have a chance of refuting the dismal view, the second-largest cryptocurrency by market cap needs to retake $1,100 as support.

Ali Martinez, a market analyst, reveals some important on-chain statistics to look out for! Martinez stated that there has lately been a significant increase in the supply of ETH on the exchanges, citing statistics from Glassnode. He stated:

“More than 200,000 $ETH. worth over $200 million, have been sent to known cryptocurrency exchange wallets over the past five days.”

Source: Ali Martinez

The number of ETH addresses that have experienced losses as a result of the current correction has also increased significantly. This can result in another sell-off. According to Ali Martinez:

“Ethereum is at risk of a steep correction. Transaction history shows that nearly 468,000 addresses with more than 7 million #ETH are now underwater and could soon start exiting their positions. A spike in selling pressure could trigger a downswing to $700 or even $600.”

ETH/USD trades above $1k. Source: TradingView

Related reading | TA: Ethereum Key Indicators Suggest A Sharp Drop Below $1K

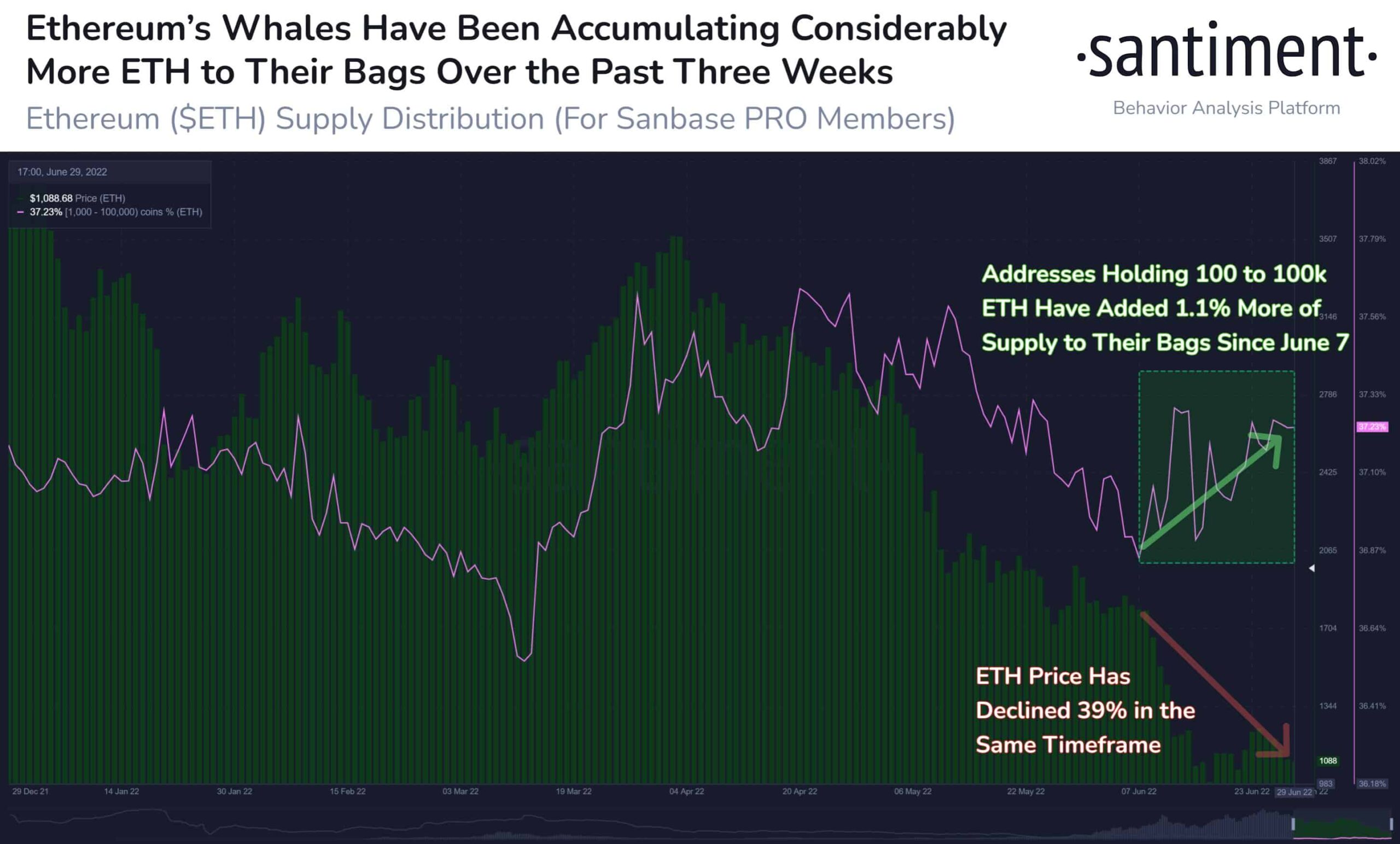

Ethereum Whales Continue To Accumulate

Despite the current chaos in the price of ETH, whales have persisted in demonstrating their might with sporadic accumulations. Santiment, on-chain data source, noted:

“Ethereum shark and whale addresses (holding between 100 to 100k $ETH) have collectively added 1.1% more of the coin’s supply to their bags on this -39% dip. Historical evidence points to this tier group having alpha on future price movement”

Source: Santiment

As of late, the state of the world economy and market circumstances appears dire. Recent figures show a significant decline in consumer confidence in the market, which could increase selling pressure on American equity.

The ripple effects can persist further because the cryptocurrency market is already seeing a more severe correction.

Related Reading | Why Ethereum Could Trade At $500 If These Conditions Are Met

Featured Image from Pixabay and Chart from tradingview.com, Santiment, Glassnode