Meta set itself a high benchmark when it first unveiled the Horizon Worlds platform and the Metaverse concept. The firm promised large-scale hopes in a short period. While Meta’s expectations and marketing predicted quick adoption, the firm’s Metaverse ambitions fell dormant.

A recent post by the Menlo Park-based firm noted that while the hype cycle dwindled, with many eyes turning towards the genAI booms, including Meta’s, the firm remains “committed to both.”

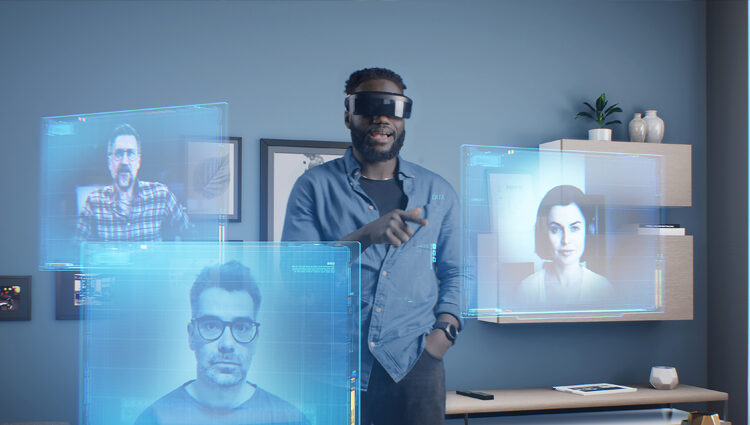

Meta was also keen to communicate the “promising opportunities” for Metaverse use cases in the enterprise sector.

Meta states that training and education hold potential value for shared immersive experiences. In the same blog post, Meta noted its tapping into XR’s impact on learning outcomes today.

The firm also highlighted a collaboration demo named Caddy, which enables remote groups to work on VR/MR CAD models.

Meta notes how the Caddy demo highlights how VR/MR can increase accessibility to tools such as CAD and 3D modelling software – with Meta noting how the tech can “level the playing field.”

Moreover, Meta emphasises that its Metaverse research could soon benefit many sectors, including healthcare, sports, and entrepreneurship.

According to Meta, consumer interest in VR/MR applications via the Quest portfolio is also increasing. Notably, fitness and wellness appear to be leading consumer use cases for VR/MR on the Quest – with such applications topping recent sales charts.

Meta is Committed to the Metaverse

The news follows a lull of interest in the Metaverse from consumers and Meta themselves, with the firm not mentioning the investment in at least one year’s Connect showcase.

It appeared that Meta would instead focus on XR gaming and AR-lite consumer wearables.

However, to conclude the year, Meta’s XR research division turned a quarterly profit for the first time, earning £1 billion in that period – following what the firm called a year of efficiency. Reality Labs gained $1 billion during the closing three months of 2023. While the Reality Labs division lost $4.65 billion across 2023, the quarterly earnings proved positive.

That year of efficiency may have given Meta the time to step back from its lofty ambitions and strategise a new way to take on the ever-emerging XR space.

Seemingly, that re-organised strategy is underway. Mark Zuckerberg, the CEO of Meta, recently met with William Cho, the CEO of LG, and Park Hyoung-sei, the President of the Home Entertainment Company, at LG Twin Towers in Yeouido, Seoul. The two-hour meeting was held to discuss the possibility of future collaborations on XR devices between the two companies.

The meeting began a strategic collaboration between LG and Meta to advance the development of XR devices and customer experience innovations. During the discussion, LG’s William Cho tested out the Meta Quest 3 headset, Ray-Ban Meta smart glasses, and large-language models and expressed interest in leveraging Meta’s technology for AI-ready XR devices.

LG also believes it can create a technology ecosystem by combining its TV division services with Meta’s XR portfolio. The company plans to showcase the benefits of its smart device OS, which could potentially provide a valuable source of income and services for Meta’s XR hardware ecosystem.

LG’s smart OS has a platform worth approximately $750.5 million from app revenue, which could help Meta compete with Apple’s already well-established Vision Pro offerings.

Notably, the busy past few months come as Meta seemingly waves goodbye to the final echos of Oculus, with the firm removing all Oculus accounts and related data by the end of the month.

Meta’s move means that a Quest user who logs into their XR device with an Oculus account will no longer be able to do so by the end of the month. Additionally, all data linked to a user’s Oculus account will disappear by the end of March.

Perhaps combining minor rumblings within Meta’s XR divisions could spell big moves in the coming months.